Replace VAT Date CZ with VAT Reporting Date - Czechia

Important

This content is archived and is not being updated. For the latest documentation, go to What's new and planned for Dynamics 365 Business Central. For the latest release plans, go to Dynamics 365, Power Platform, and Cloud for Industry release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users, automatically | - |  Apr 1, 2023

Apr 1, 2023 |

Business value

You can report VAT statements and returns based on the new VAT Date instead of the Posting Date to meet requirements by certain countries.

Feature details

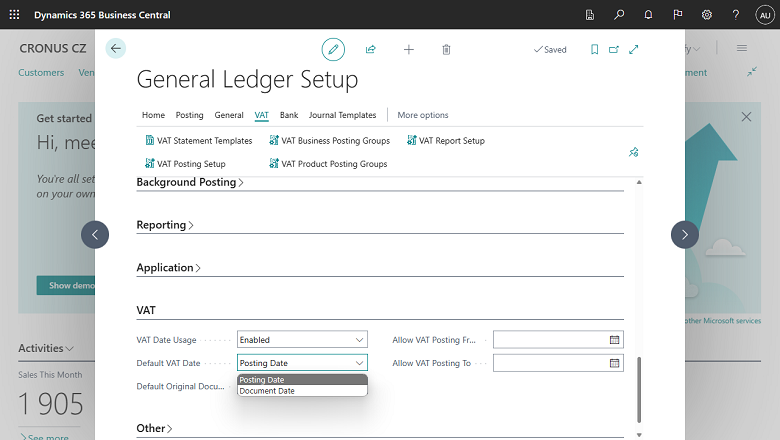

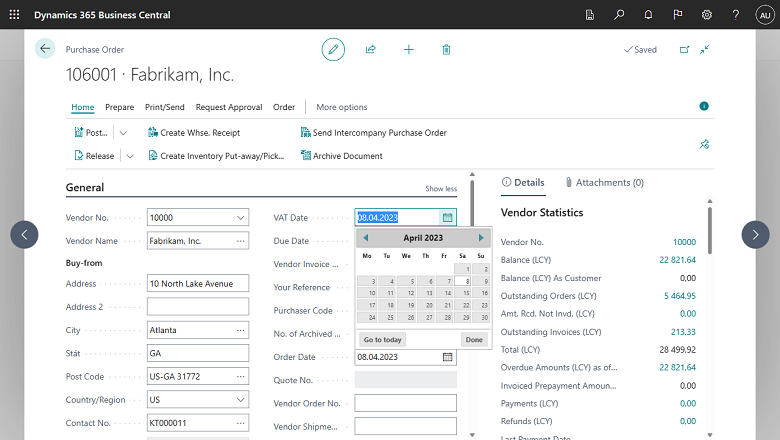

Some countries require reporting for VAT statements and VAT returns by using a date that's different than the posting date. Sometimes, the date can be the document date, but even this date can differ from the requirement. For this reason, the new VAT Date exists on all purchase and sales documents and on journals. Before you start, set up the default value for the VAT Date (either the posting date or the document date) in the General Ledger Setup. The date can be changed on individual documents and journals. When a document is posted, the new VAT Date will be visible in VAT entries and in general ledger entries.