What is a letter of credit?

Letters of credit are bank documents that are commonly used for the purchase and sale of goods across international borders.

Letters of credit are used for international transactions to ensure that payments will be made. A letter of credit is an agreement that is issued by a bank, in which the bank agrees to ensure payment on behalf of the buyer, if the terms of the agreement between the buyer and seller are met. Note that a letter of credit is also referred to as a documentary credit (DC).

For an import letter of credit, the organization is the buyer or the applicant for the letter of credit. For an export letter of credit, the organization is the seller or the beneficiary of the letter of credit. The following parties are involved with a letter of credit:

- The applicant (buyer) who intends to pay for the goods.

- The beneficiary (seller) who will receive the payment.

- The issuing bank that issues the letter of credit.

- The advising bank that carries out the transaction on behalf of the applicant.

The letter of credit includes a description of the goods, any required documents, the date of shipment, and the expiration date after which payment will not be made. The issuing bank collects a margin for the letter of credit.

A letter of credit can be revocable or irrevocable. The nature of a letter of credit can be transferable, nontransferable, or revolving. Typically, a letter of credit is an irrevocable and confirmed agreement that payment will be made to a specific beneficiary upon submission of complete and accurate shipping documentation.

A letter of credit allows you to:

- Generate a report of the bank facilities and their uses.

- Generate the entries for the letter of credit.

- Print the letter of credit application page.

- Enter the letter of credit details.

- Amend the letter of credit.

- Record letter of credit margin payments.

- Allocate a margin amount to shipments.

- Associate a packing slip in a purchase order with the letter of credit shipment details.

- Process a payment for the invoice.

- View the cash flow forecast according to the letter of credit.

- Print various reports and inquiries that are related to the letter of credit.

- Generate a vendor statement.

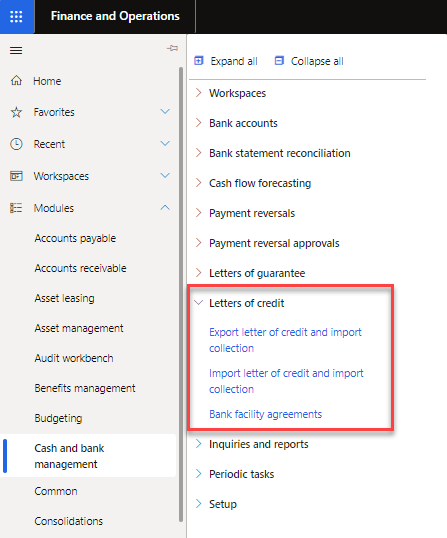

Cash and bank management > Letters of credit