Dispose of fixed assets as scrap

This unit describes the process of scrapping a fixed asset.

The asset in this example is a vehicle.

Create a fixed asset disposal journal to scrap a fixed asset

You can create a fixed asset disposal proposal by going to the Fixed assets module, selecting the Journal entries group, and then selecting the Fixed assets journal menu item.

Select New to create a new journal. You need to use several names when multiple books exist.

Select the journal name that posts to the Current posting layer. In this case, the journal name is FACur.

Select the journal number or the Lines button on the Action Pane to open the Journal lines page.

On the line, select Disposal - scrap in the Transaction type field.

To dispose of a single fixed asset, enter the asset number in the Account field.

You can also enter a Description.

Don't enter a value for the line. The value of the asset is zero.

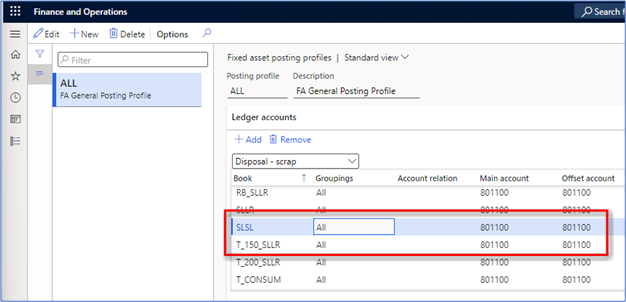

The Fixed asset posting profile determines which offset ledger account to use. To view the profile, go to the Fixed assets module, select Setup, and then select Fixed asset posting profiles.

Select Disposal - scrap in the Ledger accounts dropdown list and then scroll to the SLSL asset book.

The financial dimensions that the system uses come from the fixed asset book. In this example, the system uses business unit 002 in the offset ledger account and the asset account.

Select the Financial dimensions menu item and then select Account.

Post the journal by selecting the Post button.

After you post the journal, the system adds a line to it. This line depreciates the asset from the last date that it was depreciated through the current date.

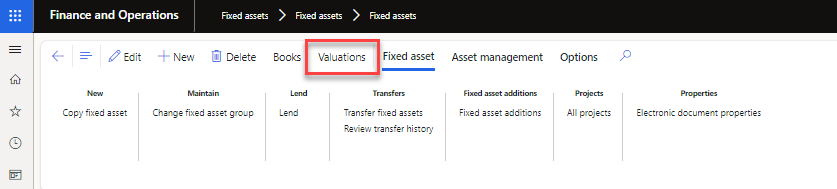

Review the fixed asset valuation

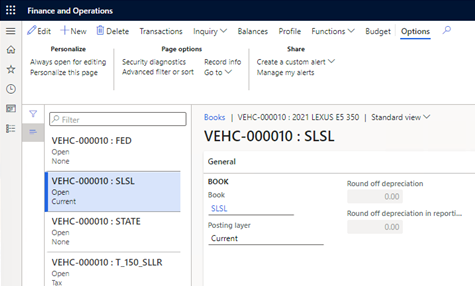

To understand the postings that occur for this asset, go to Fixed assets > Valuations page. Two asset books post: the SLSL book posts to the Current layer, and the T_150_SLLR posts to the Tax layer. Focus on the SLSL asset book for this exercise because that's the one that's selected for this sale.

Before the sale, the organization acquired the asset for USD 40,000.00, and the amount in depreciation is USD 8,000.04. The Net book value is USD 31,996.96.

To view the valuation, go to the Fixed assets module and then select the Fixed assets menu, which displays the Fixed assets list page. Select the Valuations menu item on the list page.

The current valuation displays for each of the four books that the asset has. This unit focuses on the SLSL asset book.

After the scrap disposal, the valuation shows that the Net book value is zero because the asset is no longer on the books. The system records the Net book value before scrapping as a loss in the Profit/Loss line.

Review the voucher

Go to the Voucher menu item above the lines grid to view the voucher that results from posting the fixed asset journal.

Postings are made to the Tax layer from asset book T_150_SLLR. The other two asset books don't post to any layers. For this example, you're only looking at postings to the Current posting layer from asset book SLSL.

As a result of these postings, the system:

Posts catch-up depreciation of USD 476.19 for the final period.

Credits the asset acquisition value and debits depreciation because you no longer own the asset.

Records a loss of USD 31,523.77, which is the Net book value of the asset when you scrapped it.

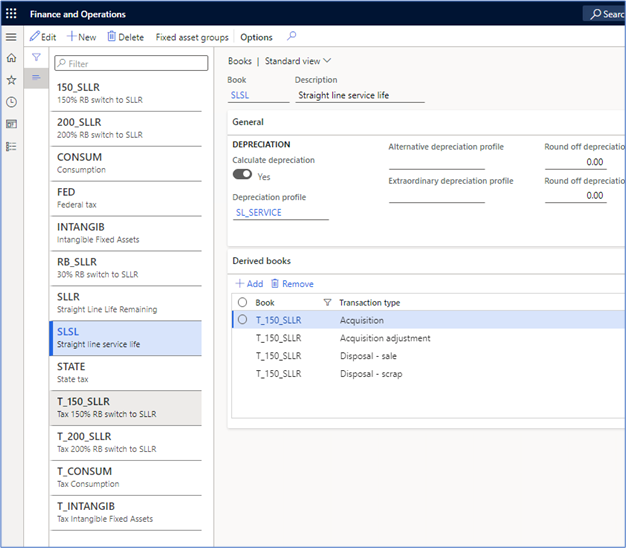

The main account on the journal line comes from the fixed asset posting profile for Disposal - scrap. Though you select the SLSL asset book for the sale, the system lists the T_150_SLLR asset book as a Derived book of SLSL for Disposal - scrap. Now, you need to post for scrap of a fixed asset in book T_150_SLLR whenever the scrap is posted for asset book SLSL. For this example, you only review the SLSL book postings.

Review posting setups

Your next task is to review the posting setups.

Asset books/derived books

Four books are in Fixed assets setup. The fixed asset in this example is recording transactions against all four books. To view the asset books for a fixed asset, select the Books menu item on the Action Pane of the Fixed assets list page or Details page.

Two books aren't posting to the ledger. The SLSL book is posting to the Current layer, and the T_150_SLLR book is posting to the Tax layer.

The books are set up so that postings to one book also post to books that are listed as derived books. The example in this unit posts to the SLSL asset book and the derived books. The following screenshot shows the transaction postings.

The system records transactions for Acquisition and for Disposal - scrap in the T_150_SLLR book when you post them to the SLSL asset book.

The system posts depreciation with individual postings to each asset book. The fixed asset scrap disposal in the Current layer for the SLSL asset book also posts to the Tax layer for asset book T_150_SLLR.

Fixed asset posting profile - Ledger account tab

To view the fixed asset posting profile, go to the Fixed assets module, select Setup, and then select Fixed asset profile.

Scrap

The scrap disposal uses the settings for Disposal - scrap on the Ledger accounts tab of the posting profile.

| Debit | Credit | Account | Reason |

|---|---|---|---|

| 31,523.77 | 801100 | Selling price | |

| 31,523.77 | 801100 | Offset |

Catch-up depreciation

To record depreciation for the final days in the final month that the fixed asset was on your books, use the specified Depreciation accounts on the Ledger accounts tab.

| Debit | Credit | Account | Reason |

|---|---|---|---|

| 476.19 | 180200 | Depreciation, final period | |

| 476.19 | 607200 | Offset |

Fixed asset profile - Disposal tab

The Disposal tab of the Fixed assets profile has more accounts that might be required when an asset is sold or scrapped. Make sure that you select Sale in the dropdown list that appears above the grid.

Net book value

The first account that your sale uses is the Net book value entries. The system credits the Net book value of your asset to remove the asset from the ledger. This example is another case where the main account and offset are the same account. Though these entries are posted, they offset one another.

Note

The system reduces the net book value by the final depreciation entry that you made after selling the asset.

| Debit | Credit | Account | Reason |

|---|---|---|---|

| 31,523.77 | 801100 | Reduce net book value | |

| 31,523.77 | 801100 | Offset |

Acquisition cost

To debit the original acquisition cost, use the Sale - Acquisition entries on the Disposal tab.

| Debit | Credit | Account | Reason |

|---|---|---|---|

| 40,000.00 | 180100 | Acquisition value | |

| 40,000.00 | 801100 | Offset |

Originally, the acquisition debited the 180100 account, which is now credited.

Depreciation

Debit the depreciation expense for previous and current years by using the Depreciation (prior years) and Depreciation (this year) entries on the Disposal - sale FastTab.

| Debit | Credit | Account | Reason |

|---|---|---|---|

| 7,333.37 | 180200 | Depreciation (prior years) | |

| 7,333.37 | 801100 | Offset | |

| 666.67 | 180200 | Depreciation (this year) | |

| 666.67 | 801100 | Offset |

The original depreciation vouchers (one each month) debited the 180200 account, which is now being credited.

The system records a depreciation adjustment to offset the final period depreciation that you posted as part of the sale. This adjustment uses the Depreciation adjustment (this year) entries.

| Debit | Credit | Account | Reason |

|---|---|---|---|

| 476.19 | 180200 | Depreciation adjustment (this year) | |

| 476.19 | 801100 | Offset |

Fixed asset status

The fixed asset status changes to Scrapped on the date that you post the fixed asset journal. The sales value on the Asset book page is zero. Display the asset books by selecting the Books menu item on the Fixed assets page.

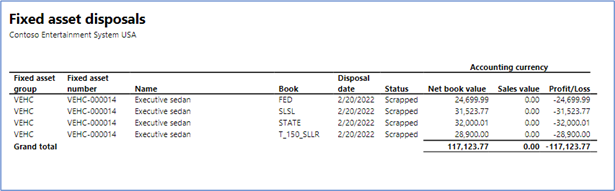

Fixed asset disposals report

The Fixed asset disposals report shows the sale. Run this report from the Fixed assets module by selecting Inquiries and reports. Select Transaction reports and then select the Fixed asset disposals menu item. Each asset book records its own values; therefore, you should review each line separately rather than the total.