Manage charges for purchase orders

Charges are costs and fees that you can add to the cost of items and purchases according to the setup. The following are examples of charges:

- Freight

- Transport

- Postage

- Insurance

- Recycling

- Packaging

Methods that you can use to add charges to a purchase order are:

Price charges - This is a fixed charge that is set up for a specific item, for example, a startup fee that is charged every time that the item is traded. The Price charges feature is set up on the Released products page.

Manual setup of charges - You can add this kind of charge manually to the order header or order line of a sales or purchase order. An example is a one-time fee that is charged to the whole order or a specific line on an order. You can also add this kind of charge to purchase order invoice header or lines. This type of charge uses charge codes, for example, if you need to assign a charge code for freight based on a fixed, percent, pcs., or other options for different currencies. This charge is set up at the header level under Purchase order > Purchase action tab > Charges > Maintain charges and at the line level under Financials > Charges > Maintain charges.

Automatic setup of charges - This kind of charge is set to automatically add charges when you create a purchase or sales order. This charge is set up in the Accounts receivable, Accounts payable, or Procurement and sourcing modules under Setup > Charges > Automatic charges.

Price charges

A price charge is an amount that is added to the price of an item. A charge could be production and setup costs, fees, or freight.

You can set up price charges by using one of the following methods:

Independent of the quantity of the items. The charge is a fixed amount that is added to the order price independently of the item quantity. Whether 10 or 20 items are sold, the charges on the order line are the same.

Dependent on the quantity of items. The charge is calculated based on the item quantity and added to the order line.

Consider the following example:

An item costs USD 10.00, and when you purchase the item, an additional USD 2.00 is added to the total price to cover the cost of transport. Instead of always adding the USD 2.00 charge on the purchase order line, the price charge is added to the item to make sure that the charge is always included. This charge is specified on the Items page for that item on the Price/discount tab. The parameter setup in the Base purchase price field group is as follows:

- Price: 10.00

- Price unit: 1.00

- Price charges: 2.00

When you create a purchase order for five of these items, the Net amount on the purchase order line shows USD 52.00 because the USD 2.00 charges are added to the price for all five items.

View the total charges on the Line details FastTab by selecting the Price and discount tab on the purchase order line and viewing the Charges on purchase field.

Charges codes

Before you plan to add manual or automatic charges when you create a sales or purchase order, you must set up charges codes. These codes are used to define the type of charge and how the charge is going to be debited or credited.

The following fields are available on the Charges code page:

- Charges code - Must be a unique code in the legal entity to identify the charge.

- Description - Brief description about the charge, the more intuitive the better. You are limited to 30 characters.

- Item sales tax group - You can default the item sales tax group that can be used for calculating taxes for the charges code.

- Maximum amount - You can set the maximum amount allowed for the charge code.

On the Posting FastTab, you can define how to automatically debit and credit the charge. Both debit and credit sections have the following fields:

Debit type/Credit type:

- Item - Charge is added to the item cost.

- Ledger Account - Charge is billed internally to the ledger account.

- Customer/Vendor - Charge is billed to the customer/vendor.

Debit posting/Credit posting - Identifies the posting type for the charge code. For more information regarding posting types, refer to Create fiscal calendars, years, and periods in Dynamics 365 Finance and Configure ledgers and journals in Dynamics 365 Finance.

Account - You need to define the ledger account that must be debited/credited when the Debit or Credit type is set to Ledger Account.

Compare purchase order and invoice values - If this option is selected, the charges values for the current charges code are included in comparisons for purchase orders and invoices. You can view the comparisons on the Charges totals details - Invoice page. This field is available only in Accounts payable, and only if the debit type or credit type is Customer/Vendor.

Manual charges

When you create a sales or purchase order, you can add charges to the order header and/or the order lines. Typically, you can manually add charges to a sales or purchase order when the charges apply only to the specific order.

For example, a customer calls and requests a large order. Because this is not a common order for the customer, the order taker adds the charges directly to the sales order instead of setting up charges for the item.

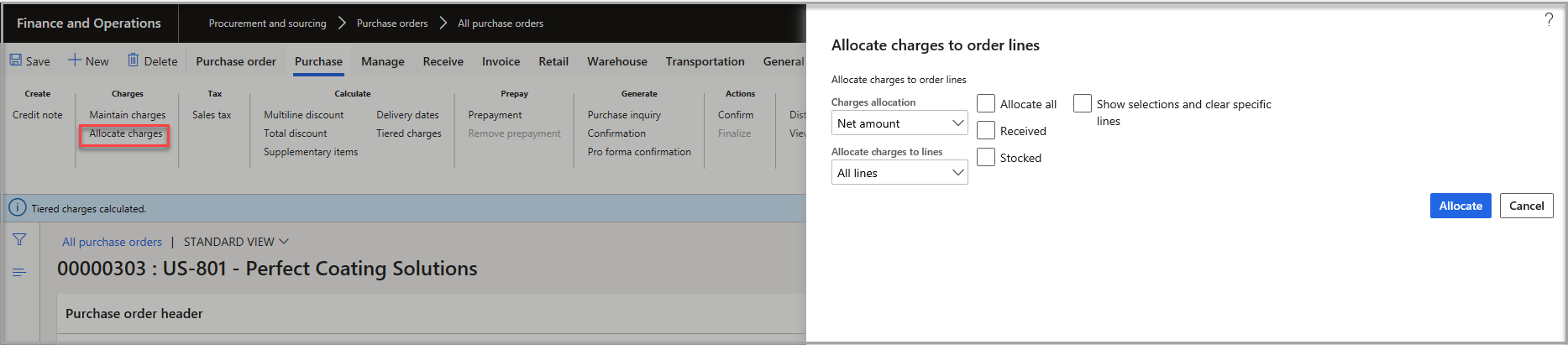

The process for the manual setup of a charge for a purchase order resembles the setup for a sales order. However, for purchase orders, the header charges must be allocated to the lines.

Typically, you will allocate charges to the lines when the cost must be allocated to each line item in a purchase order. When you add charges to the purchase order header, determine how the charges are to be allocated to the lines by selecting the Allocate charges in the Charges group option of the Purchase tab on the Action Pane.

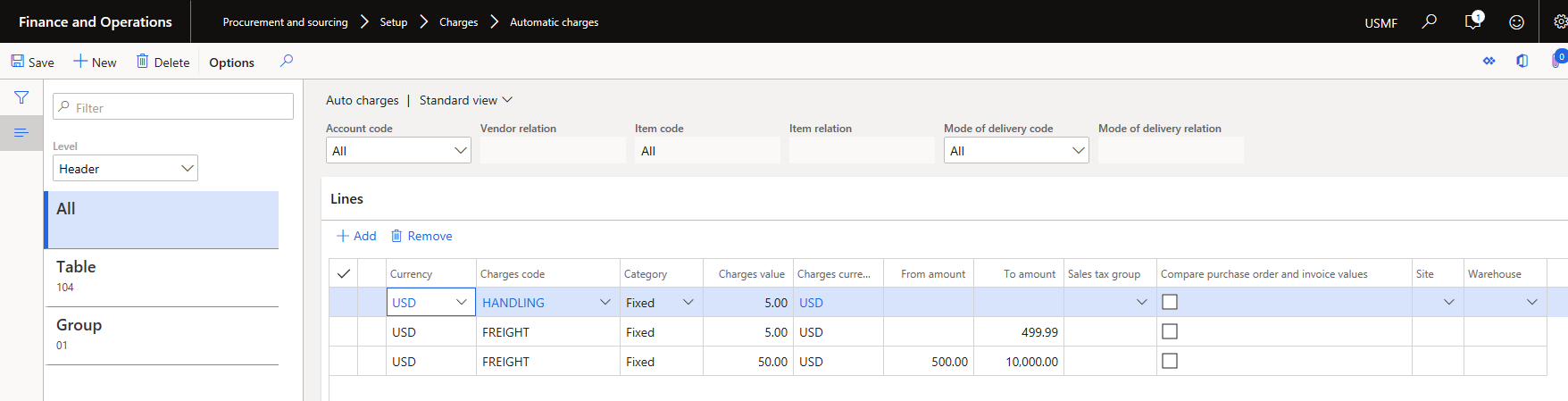

Automatic charges

Automatic charges, which are referred to as auto charges, are applied automatically when you create a purchase order. You can define auto charges for a specific customer or item, or for groups of customers or all items. This charge is set up in the Accounts receivable, Accounts payable, or Procurement and sourcing modules under Setup > Charges > Auto charges.

In the Level field, select the level to which to apply the auto charge. The options are: Header, which applies charges to the order header or Line, which applies charges to the order lines.

Select an account in the Account code dropdown to be Table to assign charges to a specific customer, Group to assign charges to a miscellaneous Charges group, or All which assigns charges to all customers.

In the Vendor relation dropdown, select a specific customer if you selected Table, or select a customer charges group if you selected Group.

In the Item code dropdown, select an item code. You can select an item code only when you define auto charges at the lines level. If you select Table, the system assigns charges to a specific item. Choose Group to assign charges to an item charges group, or select All to assign charges to all items. (Line level only).

In the Item relation dropdown, select a specific item if you selected Table, or select an item charges group if you selected Group.

In the Mode of delivery code dropdown, select the mode of delivery code. If you select Table, the system assigns charges to a mode of delivery. Choose Group to assign charges to mode of delivery group, or select All to assign charges to all modes of delivery

In the Mode of delivery relation dropdown, select a specific mode of delivery if you selected Table, or select mode of delivery charges group if you selected Group.

Expand the Lines FastTab.

In the Currency field, select the currency to use to calculate the charge.

Select the Charge code from the dropdown. Before you plan to add automatic charges when you create a purchase order, you must set up charges codes first. These codes are used to define the type of charge and how the charge is going to be debited or credited.

Choose the Category of the charge, such as fixed amount, percent, etc.

Fixed - The charge is entered as a fixed amount on the line. Fixed charges can be used on charges in the order header and on the order lines.

Pcs. - The charge is based on the unit. These charges can be used only on order lines.

Percent - The charge is entered as a percentage on the line. Percentage charges can be used on charges in the order header and on the order lines.

Intercompany percent - The charge is entered as a percentage on the line for intercompany orders. Intercompany percentage charges can be used only on order lines.

External - The charge is calculated by a third-party service that is associated with one or more shipping carriers.

Enter the Charge value as it pertains to the Category of the charge.

If applicable, in the Charges currency code field, specify a currency for the charge to use a different currency than is specified in the Currency field. This is possible if the Debit or Credit type is either Ledger account or Item for the selected charges code.

If applicable, specify a starting amount to apply the auto charge to in the From amount field. In the To amount field, specify the ending amount to apply the auto charge to. Amount in this context refers to the order total. This is optional and header level only.

If applicable, select the Sales tax group.

By selecting the Keep check box, you can keep the charges transaction after invoicing.

If applicable, select Site and Warehouse from the dropdowns for charges to be applied to (optional).

Once the automatic charges are set up, when lines have been added to a new purchase order, select Tiered charges on the Purchase Action Pane. Then select the Allocate charges button to apply the charges as expected.